kentucky lottery tax calculator

Any other bet if the proceeds are equal to. All calculated figures are based on a sole prize winner and factor in an initial 24 federal tax withholding.

Best Lottery Tax Calculator Lotto Lump Sum Annuity Payout

For example lets say you elected to receive your lottery winnings in the form of annuity payments and received 50000 in 2019.

. This tool helps you calculate the exact amount. Each Lucky For Life play costs 2. That may not sound like a lot but it adds up very quickly.

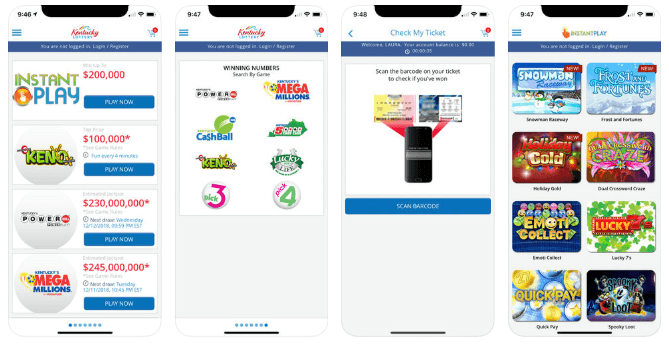

How to Play Lucky For Life. Lucky For Life drawings are conducted daily about 1035pm ET 935pm CT. Any lottery sweepstakes or betting pool.

Recently the Mega Millions hit a whopping 1 billion. Lottery Winning Taxes in India. Lottery taxes are anything but simple the exact amount you have to pay depends on the size of the jackpot the statecity you live in the state you bought the ticket in and a few other factors.

Just input the estimated jackpot amount select your state and our Mega Millions payout calculator will do all the rest. Video of the Day. Probably much less than you think.

Choose five white balls 1 - 48 and one Lucky Ball 1 - 18 or select Quick Pick to let the computer randomly select your numbers. The Powerball annuity jackpot is awarded according to an annually-increasing rate schedule which increases the amount of the annuity payment every year. Our Kentucky State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 4000000 and.

Lottery taxes are complicated. Current Mega Millions Jackpot. The lottery automatically withholds 24 of the jackpot payment for federal.

You can enter any numeric value making it easy to learn about different tax amounts for various sums. You must report that money as income on your 2019 tax return. Lottery Payout Calculator is a tool for calculating lump sum payout and.

The Lottery Tax Calculator- calculates the tax lump sum annuity payment after lotto or lottery winnings. Taxes on a 250000 lottery would be 17500 based on their states guidelines of 7. 5 Kentucky state tax on lottery winnings in USA.

Lottery tax rate is 65. A lottery payout calculator can also calculate how much tax youll pay on your lottery winnings using current tax laws in each state. Disclaimer This tool is intended for informational educational and entertainment purposes only.

25 State Tax. Lottery tax calculator takes 699. Capital gains are taxed as regular income in Kentucky.

Weve created this calculator to help you give an estimate. Lottery tax calculator takes 765 on 2000 or more. Tuesday Jun 14 2022.

5 Kansas 5 Kentucky 5 Louisiana 5 Maine. This varies across states and can range from 0 to more than 8. Lottery tax calculator takes 6.

Lottery tax calculator takes 6. Kentucky imposes a 6 percent tax rate on all lottery winnings. And you must report the entire amount you receive each year on your tax return.

Overview of Kentucky Taxes. Lottery tax calculator takes 0 percent since there is no lottery in the state. Pick your state This is the state where you purchased the ticket.

If you held the winning ticket for that drawing you would have paid 60 million right off the top to the state of Kentucky alone. Aside from state and federal taxes many Kentucky residents are subject to local taxes which are called occupational taxes. Although it sounds like the full lottery taxes applied to players in the United States that is the harsh condition for players of lottery games in India.

The tax rate is the same no matter what filing status you use. There are no hidden fees or charges. To use our Powerball calculator just type in the advertised jackpot amount and select your state and the calculator will do the rest.

Please note the amounts shown are very close. After you are done check out our guide on the best lottery prediction software for tools that will help increase your odds of winning - significantly. Kentucky imposes a flat income tax of 5.

To use our Kentucky Salary Tax. For most counties and cities in the Bluegrass State this is a percentage of taxpayers. He went home and after putting his groceries away scratched off the ticket.

5 Louisiana state tax on lottery. Kentucky Capital Gains Tax. Garcia purchased the 2000000 Diamond Dazzler ticket while shopping at his local Kroger.

Calculate your lottery lump sum or annuity payout using an online lottery payout calculator or manually calculate it yourself at home. Heres a quick guide on how to use our lottery tax calculator. That means your winnings are taxed the same as your wages or salary.

That means they are subject to the full income tax at a rate of 5. Kentucky Cigarette Tax. Lottery Calculator provides Federal and statelocal taxes and payout after Powerball Mega Millions winning.

Jackpot size If you won a huge lottery prize enter the exact sum here. After winning 50000 on a Kentucky Lottery Scratch-off ticket Adam Garcia of Lexington KY says winning feels like a dream. The calculator will display the taxes owed and the net jackpot what you take home after taxes.

The tax rate is the same no matter what filing status you use. Imagine having to pay 28 in taxes on your precious lottery winnings. In 2018 Kentucky legislators raised the cigarette tax by 50 cents bringing it up to 110 per pack of 20.

Believe it or not the tax used to be even higher at 309. Gambling winnings are typically subject to a flat 24 tax. Mon Jun 06 080000 EDT 2022.

Choose the number of drawings you want to play. We might show you 3 rd party ads or affiliate links. There may be changes to the federal and state tax rate.

However for the activities listed below winnings over 5000 will be subject to income tax withholding. After you are done check out our guide on the best lottery prediction software for tools that will help increase your odds of winning - significantly. You can read more about this in our TC document.

The table below shows the payout schedule for a jackpot of 229000000 for a ticket purchased in Kentucky including taxes withheld. This is still below the national average.

Kentucky Lottery Ky Results Winning Numbers Fun Facts

Taxes On Lottery Winnings In Kentucky Sapling

Lottery Tax Calculator Updated 2022 Lottery N Go

Lottery Taxes The Triple Tax Effect Ellsworth Associates Cpas Accountants In Cincinnati

Usa Lottery Tax Calculators Comparethelotto Com

Usa Lottery Tax Calculators Comparethelotto Com

Best Lottery Tax Calculator Lotto Lump Sum Annuity Payout

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Usa Lottery Tax Calculators Comparethelotto Com

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

How Long After Winning The Lottery Do You Get The Money

Best Lottery Tax Calculator Lotto Lump Sum Annuity Payout

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Lottery Tax Calculator Updated 2022 Lottery N Go

Lottery Tax Calculator Updated 2022 Lottery N Go